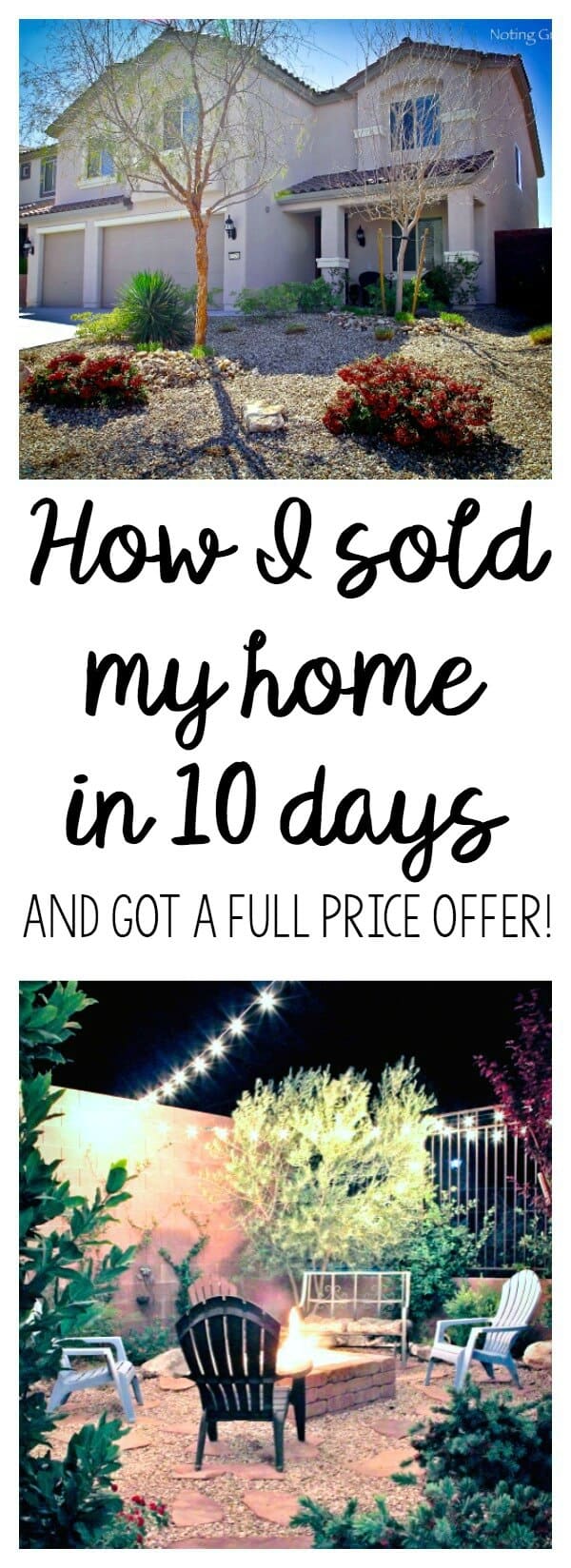

Selling Your Home Series – Getting the Numbers

Do you often visit Zillow to find out what your house is worth on the market?

I’ve recently learned the inaccuracy of what you think your home is valued at in using sites like Zillow.

This first post, Selling Your Home Series Getting the Numbers, talks about getting your information from a reputable source so you are properly prepared to price your home right.

Here is what our realtor says about Getting the Numbers.

“Online home value calculators are a very popular way to get a quick and easy home value estimate in the privacy of your own home without waiting. HOWEVER, I have found these online property value calculators wrong more often than not – especially if your home sports some unique characteristics that could enhance your home’s property value.”

Some of the unique items that may enhance and bring up the home value may include:

- Large Lot Size

- Pool or Spa

- Upgrades

- Guard Gated Community

- Golf Frontage

- Lake Frontage

These online home value calculators sometimes adjust the property value correctly for the unique characteristic but not most of the time.

If you need to find out what your home is worth an appraisal is definitely worth the couple hundred dollars you may pay for it if it means netting tens of thousands more or an aging listing in a declining market (which can also leave money on the table if not priced right the first time around!)

Selling Your Home Series Getting the Numbers

So where can you get a free home value estimate from some human eyeballs and a brain?

Contact your realtor before you list your home to have a real assessment of the market in your area. They should be able to ‘pull comps’ of other homes that are selling and have sold in your neighborhood.

By pulling comparable sales, you can do a side by side comparison of square footage, lot size, features, and amenities. You would also be able to see which homes may have been a foreclosure or short sale, which online home valuation sites don’t always take into consideration when placing value on your equity sale.

I thought I’d put our realtor’s advice to the test to see how my home stacked up on different sites. Here’s what I found:

Homegain $257K – $301K

Trulia $332K

Zillow $331K

According to the comps in my area, my home ranges from $350K – $365K. That’s a difference of $100,000 if my home were valued at the lowest above!

Another thing I noticed is that Zillow valued my home at $331K, however, my next door neighbor has the exact model as ours, with the same lot size and we moved in within a month of each other. Zillow states their house is $30,000 less in value than ours.

So there you have it -the proof is in the pudding in this Selling Your Home Series

Getting the numbers is so important. Contact your realtor or schedule a home appraisal if needed before you think of selling to see where you home really fits on the market!

Click to read the next Selling Your Home Series post about Understanding Your Net.

Selling Your Home Series:

Getting the Numbers

The Cost of Selling

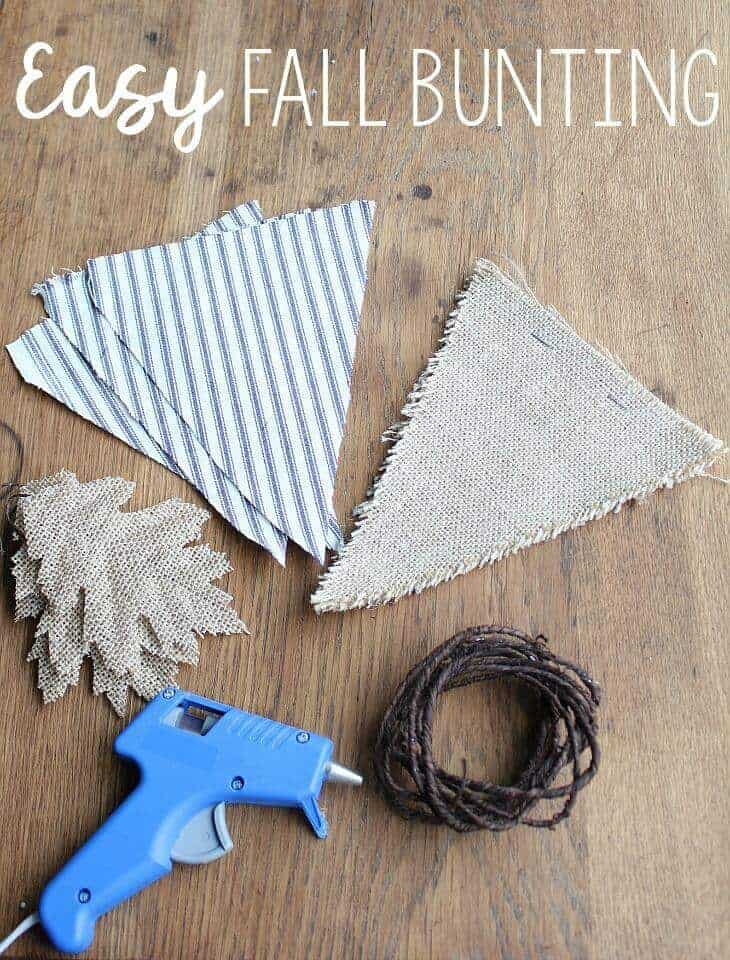

Curb Appeal

Neutral Decor

Depersonalizing Your Space

Cleaning

Here are some resources to help you more. Affiliate links provided for your convenience. Read my full disclosure here.

Interesting! Thanks for linking up to my Party!

Hello! Found you on Pin-Me-Linky-Party and this is a GREAT POST!

Plus I know Renee through Active Rain … she has fantastic information!

pippa

I stopped looking at Zillow awhile back when all the values went way down. I haven't visited in quite awhile. Great tips here. =0)

~Kim

Great ideas here!

An additional note – a lot of BUYERS rely on Zillow, etc, and won't pay more than those estimates, even if they're wrong. So, it really pays to use the Zillow feature that allows you to ask them to change their estimate when it is incorrect.