Selling Your Home Series – the Cost of Selling

One of the most important things before you sell your home is knowing the cost of selling. We’re talking about the moolah, green backs, the bottom line, how much you’ll make…. or worse-lose!

We first discussed selling our home, clueless as to what our financial responsibility could be.

Getting the numbers upfront is a smart, realistic approach to selling your home and knowing what is expected at closing.

What is the cost of selling my home?

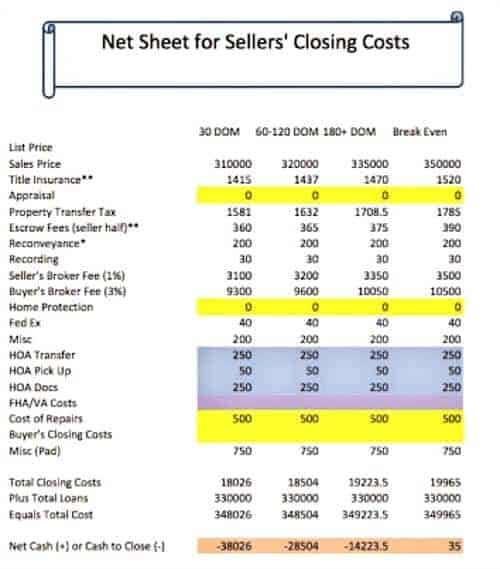

So to explain this, here is what real estate expert Renee Burrows says about Understanding Your Net.

Real Estate Expert Renee Burrows

“Many home sellers get “hung up” on what the commission is on selling their home. Sometimes they don’t understand that there are a myriad of other costs of selling a home involved (besides liens) that are usually equivalent to the commission amounts. Each scenario for a home sale is different and your mileage may vary. Here are the typical costs for selling your home:

Real Estate Agent Commission: This is negotiable! Some people think it is a “set rate.” When you are interviewing real estate agents it is common in our area to ALSO charge a transaction fee or a flat fee amount on top of your negotiated %.

Real Property Transfer Tax or RPTT

Title & Escrow Fees: Again, this is not a set rate, settlement costs & title insurance fees vary from title company to title company.

Reconveyance Fee: This is for paying off your mortgage if you have one and it runs around $300.

Recording Fee

Miscellaneous & Pad: For Fed Ex, Notary & Miscellaneous Items – $500

HOA Transfer Fees & Documents: Some areas (with governed by multiple HOAs) can expect these fees to run upwards to $1000.

Costs of Repairs: Agents sometimes write costs for repairs into the executed contract. Consider this amount for the net also. Typical costs for repairs are $500-1000. However, sometimes lenders on financed transactions ask for repairs on certain items.

Costs Pursuant to Buyer’s Loan Program: Some loan programs will not allow buyers to pay certain costs (such as VA loans). The seller will have to bear those costs. Expect that to run around 1/2 to 1% of the purchase price.

Buyer’s Closing Costs: The buyer may ask the seller to pay their closing costs for items such as home warranty, appraisal, lender costs, title costs, recurring costs, prorated costs, etc. This fee is typically 3% but can run as high as 6%. Negotiate with the buyer before executing the contract.”

When we started interviewing agents, which I discussed in my last post and highly recommend, no other realor gave me an exact breakdown of what the estimated closing costs would be, until we met Renee.

She prepared for us a detailed net sheet which broke down the sale of our house into 4 different price points.

Not only that, but also the average time to sell at each price and what was expected of us at closing.

Above all, it prepared us mentally for closing depending on the offer price.

Prepping your home is just not enough! As shown above, prepare financially for what may be expected at closing.

The cost of selling may have you losing money.

So what do you think? It’s a bit more homework to find the right realtor to provide you with these tools, but it is so worth it!

Click below to go to the next Sell Your Home Series post.

We talk about Curb Appeal and the importance of drawing the buyer in from the moment they see your property.

So be sure not to miss it!

Selling Your Home Series:

Getting the Numbers

The Cost of Selling

Curb Appeal

Neutral Decor

Depersonalizing Your Space

Cleaning

The real cost of selling your home in the current market will depend on many factors which include broker's commission, unpaid mortgage, taxes and the necessary cost to repair and renovate in order for your home to be saleable.