When to Save or Splurge for Items in Your Home

When you are making over your home or purchasing home items, when is the best time to save and when is it best to splurge as well as finding the motives behind those purchases.

Today we are talking about a hot topic.

Whenever you start discussing money and spending, one emotion or another shows up making it easy to try to forget or push that intruding thought away.

Click here to listen:

APPLE PODCASTS | SPOTIFY | AMAZON MUSIC

PODBEAN APP | I HEART RADIO

Head over to YouTube and subscribe to watch each episode every week, or check it out linked below.

When to Save or Splurge

for Items in Your Home

(Some affiliate links are provided below. Full disclosure here.)

Splurge sometimes has a bit of a negative connotation if you are just splurging for the sake of buying something.

But it can also mean there are certain items worth investing.

And while saving money is always looked upon favorably, today we are discussing when saving can possibly become a bad thing.

Worth the Splurge

Quality items that you will reuse again and again are definitely worth the investment.

There have been times when we thought we were being wise and making economical decisions only to find out that it was actually a big mistake.

For example, right before we moved to Birmingham, we went shopping for two couches from a reputable company in town that had great prices.

We did our homework and even did the sit for a while test and thought we had found a budget-friendly option.

So for about $1200, we got two large couches that worked great for our family.

But it was just a few years later, they completely fell apart.

In fact, they ended up becoming so uncomfortable that no one wanted to sit on them.

So we ended up saving for new couches and replaced them with our La-z-Boy sectional in our basement and wished we would have started with that choice years ago!

So in this case, the lesson we learned is that we should have splurged on a nicer piece of furniture that’s better quality.

That’s a great example where splurging actually means investing instead of purchasing something on a whim.

Here are a few more ideas when you should consider the splurge.

Mattresses

In a 24 hour period, we spend the majority of our time in our bed and is something that gets a lot of use.

So a quality mattress is a definite splurge item.

You can save on the bed frame and throw pillows, but in the long run, investing in something that is not only comfortable, but also makes financial sense to ensure you get good sleep.

We splurged on our Dreamcloud Mattress and still love it after almost 5 years. You can read our blog post on how it held up after 2 years.

An easy way to save is by shopping for mattresses on big holidays. You are always sure to find great deals for a fraction of the price!

I think the same goes for pillows. It’s worth the extra money when you purchase new pillows for your bed. These are our favorites and we have purchased them many times!

Tools

This is one of Trent’s favorite topics!

When it comes to power tools, it’s important to invest in a mid-level tool that will stand the test of time and plenty of DIYs.

It doesn’t have to be top of the line, but we definitely suggest steering clear of budget tools.

One tool splurge we made was finally purchasing a table saw.

We already owned many hand power tools and a miter saw, but always hesitated purchasing a table saw.

It just seemed like a such big ticket item purchase and we put it off again and again.

But once we finally had one, it became a HUGE game changer for our room renovation projects.

Our first thing we made with the table saw were the DIY Cedar Framed Mirrors in our boys’ bathroom.

Looking back on other projects, it would have been worth the investment for us to have gone ahead and purchased that sooner.

Pots and Pans

A few Christmases ago, we treated ourselves to some new frying pans and decided to go with a less expensive option.

Big mistake!

I don’t think the pan lasted 6 months before the ‘non-stick coating’ started peeling off.

In fact, over the last decade, we probably have gone through at least 7 or 8 frying pans and I have finally learned my lesson.

After tons of research, we settled on these pans from the Ninja Foodi line and they are AWESOME!

I wish we would have made this purchase much earlier and have saved hundreds of dollars over the years.

When we were getting married, Trent and I were gifted a quality set of pots and pans that are still in great shape!

So those are great idea to consider investing in a good quality set of pots and pans.

Here are a few other items worth spending the extra money for your own home:

- A Timeless Piece of furniture: If the item can stand the test of time, like a dresser or other pieces of furniture, at the end of the day, that extra cost is worth it knowing it will last you decades.

- Linens: like bedding and great towels if you have sensitive skin.

- Dining Chairs: Both my boys are super tall so finding a sturdy chair is essential for our dining room.

When is splurging a bad thing?

Now it’s time to check your heart.

We’ve seen those funny doormats with sayings instructing the delivery drivers to hide the packages.

And while that’s funny, if you are purchasing items that cause you to be sneaky or hide them so your family won’t find out, then you probably shouldn’t be purchasing it.

Finances are the number one cause of marital strife, so if your spending is causing a wedge in your family, then it may be time to reevaluate.

Even if you are single or a single parent and your purchases are causing you to neglect the important things like shelter, food, or heat, then you may need to address this issue.

So check your motives before you make the purchase.

We are in a season where time is a precious commodity, so if making a purchase is going to make your life more functional and improves quality time spent.

Save

When to comes to deciding whether to Save or Splurge, saving is usually the clear winner in our household.

It doesn’t take a lot of money to decorate with home decor and there are definitely times when it’s not worth purchasing the higher ticket items.

So how can you save when it comes to filling your home with decor you love?

Here are some tips you can use to try to get a similar look for decorative items:

DIYing

Now you know this is our bread and butter! We live for DIY-ing!

Even if we won the lottery, I’m sure I would still be getting my hands on projects to save.

But when you create your own home décor, you can get a high-end look for very little money!

I just recently updated a lamp for dollars and created a custom look that rivals some of the big ticket table lamps out there.

It can be small items like decor, but don’t forget to overlook larger ticket items.

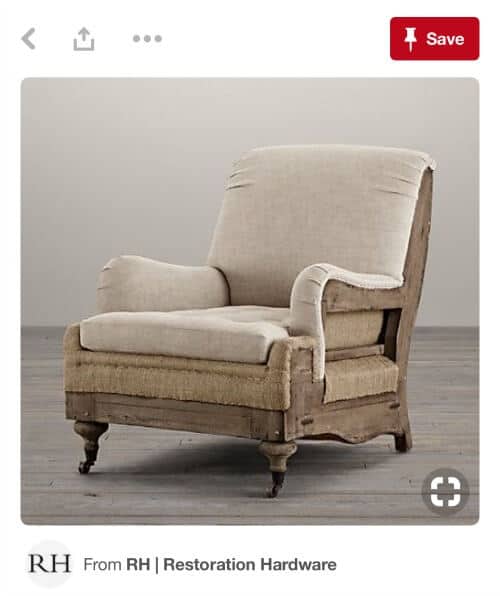

When we needed a new armchair, I found an inspiration piece that had way too many numbers before the decimal point!

So I went on the hunt for a similar chair at flea markets and craigslist and created one of my own.

It was a big project to tackle, but it’s still one of my favorite furniture flips because I saved so much money!

Trendy Items

I rarely pay full price for home decor items that are the current trend.

Either I wait for items to move to clearance, search for better deals elsewhere, or figure out how to make the same thing on my own.

You can find great deals on new decor at the Target Dollar Spot, or Hobby Lobby’s weekly deals.

Or you can also look for second hand items at thrift stores, garage sales or the Facebook marketplace that you can give a new look with a quick DIY.

Other items to consider finding deals for:

- Seasonal Items: New trends emerge each year for holiday decor.

- Decorative accents: splurge on the larger pieces in a room, but find inexpensive items for the accent pieces that may be lower quality such as accent chairs for your living room, side tables, window treatments

- Color schemes for a room: pillow covers, table lamps, or coffee table decor

- Rugs: splurge on the area rug pad but find an affordable dupe to those expensive rugs you’ve been eyeing. The pad will make the rug feel awesome and higher quality.

When is Saving a Bad Thing?

I know this is a crazy thing to consider.

But there can be a time when you are saving too much.

If you become too frugal or a penny pinching, you may miss out on a world of experience.

We only get this one life.

And if you create an idol out of saving money and never treat your kids to a movie or a vacation, then you may be robbing them of a precious memory shared with you.

Things that we hold dear to us can become idols in our life.

In this week’s podcast, Trent talked about how food was an idol before his open heart surgery which we’ve now changed our mindset.

And I was super frugal at the grocery store and compromised the healthiness and quality of food over the price.

Looking back, we both wish we would have made better decisions when it came to what we were putting in our bodies every single day.

So it’s all about finding that balance.

How do you find that balance?

What if one person is the spender and one the saver?

If you are in immense debt because your excessive spending got you there, then yes, you need to focus and get your spending under control.

But on the other hand, if you are stretching your dollar so much that it’s causing strife, then reconsider or find ways to relax a little.

You have first look at your budget.

It’s important to assign every dollar for each category and if it looks like you don’t have enough money to purchase that table lamp, then you need to wait.

Budgeting every month is a great way to learn that discipline on where your money should go.

If you’re an over spender, don’t make any large purchases without first discussing it with your spouse.

Or if you are single, have an accountability partner you trust to go over large purchases.

If making that purchase send up a red flag and makes you doubt, then that is a great time to check your motive for purchasing it.

Or if you are finding you’ve purchased 8 frying pans for $20 over the decade instead of investing in a quality one the first time, then maybe your frugal spending needs to be reevaluated.

We hope that this helps you if you find yourself struggling with when to save or splurge in your home.

If you need help making those decisions, you can even reach out to us! We always love when we get questions about design dilemmas!

Do you have more tips that you want to share?

Be sure to leave a comment below – we would love to hear your amazing suggestions!

Resources

Ways to Shop Our Home

If you’re looking for sources for items in our home, you can find them here!

From furniture, home decor items, and some of our favorite tools, small appliances and organizing bins, you can find anything you are looking for.

Since most of our projects here at Noting Grace are DIYs or thrift store finds, we’ve done our best in finding budget-friendly alternatives for you.

Happy Shopping!

More Ways to Shop

Amazon Storefront

Our regular one-stop-shop for all things home. Shop all our favorite items in our home.

Shop By Room

Love the look of one of our rooms? Shop this list to find the exact link you are looking for.

Shop our LTK

Here is where you’ll find our Instagram round ups, upcoming sales and gift guides.

Hey Elle! Thanks so much for reaching out – and that’s a great question. We just purchased the base line Dreamcloud – no frills, just the main, most affordable mattress they offer.

After 5 years, the pillow top hasn’t condensed much at all, There are 2 slight indentions where our bodies lay – Trent and I are pretty calm sleepers and don’t move much. But that has happened with all of our mattresses over the years.

It still is the best bed we’ve ever had and always look forward to returning to it after any trip we take. It’s still super comfortable and we are very happy with our purchase!

Great post with very good discussion. Thank you. Yes, mattresses are an important investment! After 16 years, we need to soon replace our innerspring mattress with pillow top which was very expensive. We had a waterbed before that. Which DreamCloud mattress did you buy? Which features did it have? Is the pillow top condensed now (after 5 years) where you sleep?