How to Organize Self Employment Taxes

Handling our self-employed taxes for the past 20 years has taught me some tips on how to stay organized and save time. Here’s how to organize self employment taxes!

If you’ve been around me for any length of time, you will quickly learn that I am mathmatically challenged.

I would even say I’m numerically challenged!

I often mix my hundreds and thousands when talking about numbers, which has given Trent a scare quite often whenever I’ve tried to share the cost of something!

But, even with all those mess ups, I am the one that handles our taxes.

That’s right, this doesn’t-play-well-with-numbers lady had her hand alllllll in the cookie jar.

And that is for a good reason.

Organization.

It’s the cloth I’m cut from and remember as a child spending hours color coordinating my crayons or lining up my Barbie shoes in a perfect row.

When Trent and I were newlyweds, I had the chance for work for financial guru Dave Ramsey, and we learned a lot in that first year of marriage!

He was the one who recommends that the one who is most organized and detailed should handle the books.

I have been known to hunt down a dime for hours when trying to balance our accounts.

When it comes to money, you don’t want a ‘close enough’ attitude.

So when we started our music career 20 years ago and became a self-employed sole proprietorship, that meant I had to learn an entirely new system for keeping up with our taxes.

For many years, it took me an entire month to tackle my taxes and I found myself dreading the season year after year.

I knew there had to be an easier way, so I worked hard to streamline the process.

There were some near hits, but lots of misses.

But I finally found a system that has saved me so much time and keeps me organized.

In fact, I finished last year’s taxes in just a couple of days! And I’m so excited to share what I’ve learned with you!

Now, here’s my great big ole disclaimer – I am not a tax professional. In fact, the first thing you need to do is get yourself a qualified CPA. We have hired one to do our self-employment taxes for years.

So while you won’t find specific tax tips in this post, you will find tips to help manage the tax prep year after year.

This is all about staying organized and saving time so that you can hand everything off to your accountant with a smile!

How to Organize Self Employment Taxes

(Some affiliate links are provided below. Full disclosure here.)

THE BASICS

If you’re a seasoned self employed individual you can skip down to the details, but I thought it was important to go over the basics for anyone just starting a business.

STEP ONE: Separate Biz/Personal Accounts

If you are already self-employed, I’m sure you already know the importance of keeping business expenses and personal finances in separate accounts.

However, just in case there is someone reading this who is baby stepping into this world of small business, this is a great place to start.

First off – it’s free to open an account at most banks.

And secondly, if you only make your purchases from your business account, then you have all your purchases organized in your bank statements.

It’s an easy expense tracker all in one place.

STEP TWO: Keep Those Receipts

It’s all about those write-offs.

And as business owners, we have many purchases for the many projects that we tackle.

It’s a good idea to keep those receipts in case you run into a tax situation where you have to show any financial transactions from your business.

I make sure to write the project on each corresponding receipt so that I know which purchases go to which project.

STEP THREE: Reconcile Your Accounts Each Month

This goes back to high school economics, but keeping your accounts balanced is the key to any successful business.

Keep your statements from the mail or print them out and make sure that the receipts match the purchases. I have found a few transaction errors that have saved me lots of money!

THE NITTY GRITTY

Okay, so now that we have the basics handled, let me share the tricks I’ve learned to save so much time.

Create a Spreadsheet

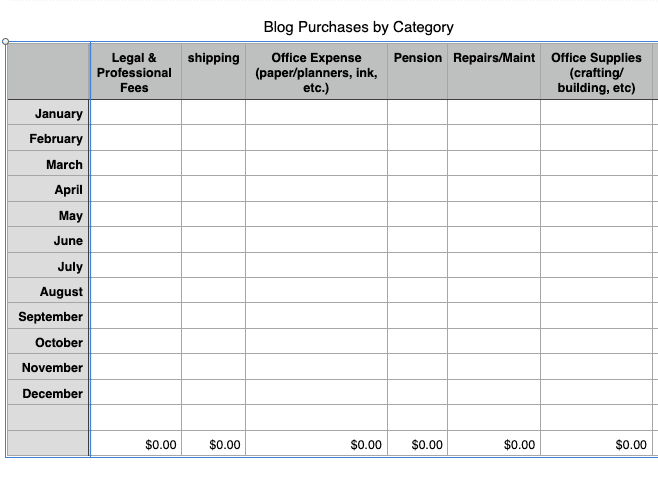

I spent a.l.o.t. of time creating a spreadsheet to enter each month’s expenses. I made sure to enter the amount by category.

For example, if I had 3 business meetings over lunch in one month, I save all the receipts and put the total for the month under my ‘meals’ category.

So take time to fine tune what categories fit your write offs.

For our business, I created an ‘office expenses’ category for the typical pen and paper type of purchases. But I also created a separate ‘office supplies’ category for my home decor or DIY purchases. All these items are deductible for my business.

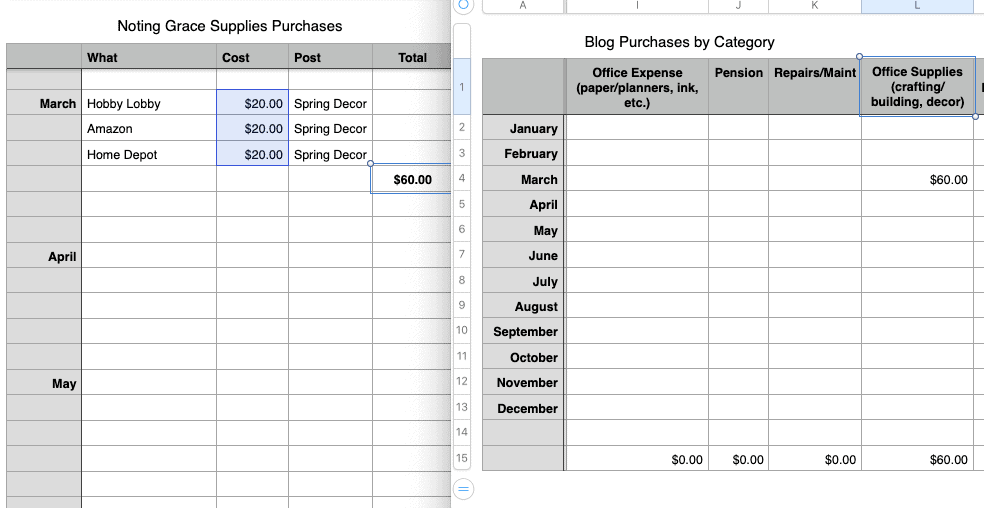

On my spreadsheet, I also created tabs for gross income, business use of our home office, as well as detailed list of each month’s purchases.

For instance, I purchase a lot of decor for seasonal items each year. I list those purchases by month with a brief description of what it was for along with the price. I add all those purchases up using the sum tool on the spreadsheet and then copy that number over to the monthly expenses.

You can see below a side by side of my supplies purchases with the sum and then how I put that sum on my category expenses.

This also helps if you keep an inventory of supplies that you write off for your business.

Trent just started a Limewashing Business and he has continual use supplies, like ladders and brushes. He can write off those equipment purchases, track mileage for those deductions, as well as health insurance. He created a limited liability company, so record keeping is key!

Be as detailed as possible when creating your spreadsheet. Let me know if you have any questions and I’m happy to help out!

Then, at the end of the year, you have everything ready for your tax preparer.

TIP: There are often many changes to the self-employment tax code. It’s worth the cost to invest in tax software, like turbotax self-employed or quickbooks.

Or hire a CPA, like we do. They know all the right tax deductions, changes in the self-employment tax rate. Plus they prepare our estimated quarterly tax payments for the year ahead. It’s worth any tax preparation fees knowing we’ve not missed an important deduction!

The Secret Sauce

Now’s here’s where I have found the ultimate time saving tool.

Every month, you are already taking time to reconcile your business bank account. Go ahead and fill out your spreadsheet for that month’s expenses.

I sit down once my bank statement arrives and reconcile each statement. I fill out my spreadsheet with each applicable purchase. Then I scan all the month’s documents and receipts onto my computer to keep a digital copy.

Once it’s all stapled together, then I know I’ve completed that month’s taxes.

By doing a little bit of tax work every month, I was able to save soooooo much time. Much better than going through an entire year all at once.

Then when the tax year is done, I wait for the tax forms to come in, like 1099-misc forms. Then I just send them over to my tax expert.

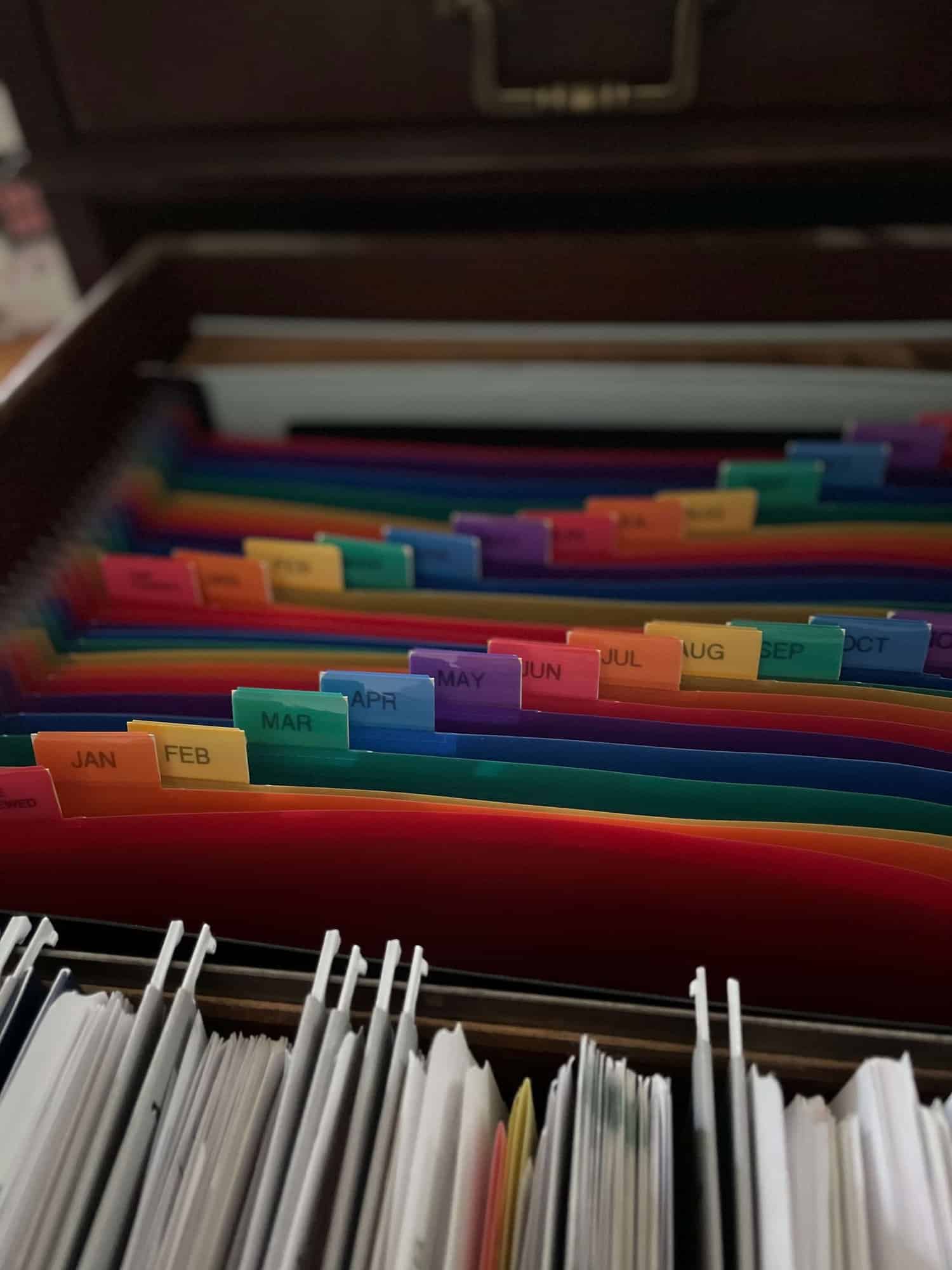

Stay Organized

This tip has helped control the mountain of paperwork that comes in as a small business owner.

Find a filing system that works for you. I recently updated our filing system with new hanging and file folders and monthly dividers to keep everything in one place.

It is so helpful to have my financial data right at hand when I need it!

I also bought this large monthly divider to store all my receipts in. Since we run multiple businesses, I needed to find an easy system to keep both sets of purchases and write offs separate.

It’s really not rocket science, but just a bit of preplanning. So if you are reading this while you are in the midst of taxes, this post may not save you time this year.

But start taking note of what categories you write off and begin creating the spreadsheet! And start implementing these tips so that you aren’t swamped with work next tax season!

And be sure to ask me any questions along the way – I am always happy to help out!

Pin This for Later!

Looking for More Help? Check Out These Posts:

Thanks so much for pinning!

Glad that helped! Good luck on your taxes!

Thank you for the idea of separating office supply expenses💸

What an informative and needed blog post. Thanks so much for sharing your experience, along with tips and tricks, Jen.

Pinned for reference.